Most of us recognize having a life insurance policy is a responsible move, especially if we have loved ones who rely on us financially. We know that life insurance is a proactive measure to protect the people we care about when we’re gone, and it can give us peace of mind while we’re living. We might even have a life insurance policy through our employer or another source. But, there’s so much information out there about life insurance policies that it can be overwhelming, never mind that it can be a sensitive topic, too.

We’re going over some basic life insurance concepts so you’ll have the building blocks to make informed decisions about your life insurance needs:

How does life insurance work?

Life insurance policies will pay a benefit to the policyholder’s beneficiary – a person named by the policyholder – upon the policyholders’s death. The beneficiary will need to submit a claim to the life insurance carrier, and will receive payments as long as the policy holder stayed current with paying premiums.

To sum it up, you pick an insurance carrier, policy type, and coverage amount, select someone to receive the payments when you pass away, then make premium payments to the insurance carrier for the policy’s duration. Funds will then be made available to your beneficiary once they submit a claim to the insurance company in the event of your death.

Who needs life insurance?

Who needs life insurance?

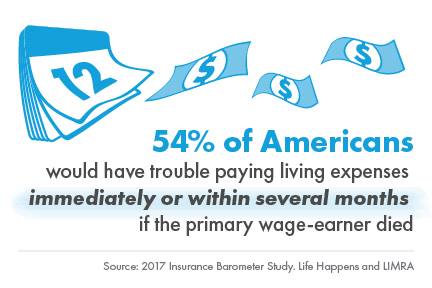

Almost everyone can benefit from having a life insurance policy, but there are some circumstances that make life insurance coverage more imperative, including:

- If you have children, a spouse, or other dependents whose daily needs are supported by your income.

- If you don’t have other means to cover your funeral and burial costs.

- If you have a mortgage, college tuition or loans, or other substantial outstanding debts which would fall to your beneficiaries to pay off in the event of your death.

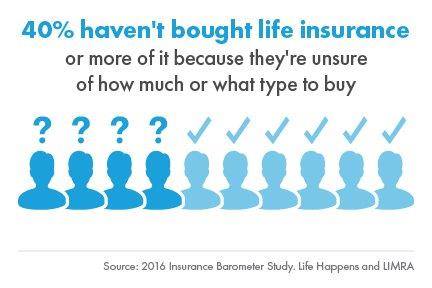

How much coverage do I need?

To determine the amount of life insurance coverage you need, you’ll want to consider factors such as your age, your income, the ages and financial needs of your dependents, and the size of your outstanding debts. A seasoned insurance agent, like those at the O’Brien Insurance Agency in Glens Falls, can work with you to select adequate coverage for your unique circumstances.

What kind of coverage is best?

What kind of coverage is best?

You’ve probably heard of term life insurance and permanent life insurance before, but like much of the general public, you may not know what’s meant by each or how these two types of life insurance coverage differ from one another.

Term life insurance provides a death benefit to your beneficiaries for the duration, or term, of an active policy. Meaning, there’s a cap on the number of years the policy lasts, or an age at which it’s no longer applicable. This option is typically less expensive, but comes with limitations.

Permanent life insurance, which may also be referred to as whole, universal, or variable, is long-term coverage with no end date. Permanent life insurance policies may have features like the ability to grow the policy’s cash value – the amount of money that accumulates from paying your premiums, tax free. You may be able to draw on your permanent life insurance policy’s cash value if you encounter unexpected financial hardships.

Some insurance carriers offer convertible policies that start as term life insurance and transition to permanent life insurance as the policy matures. Insurance agents can help you sort through which type of policy is right for you.

How much does life insurance cost?

Life insurance premiums vary based on age, health, gender, lifestyle, and occupation. It’s usually possible to find affordable life insurance options for any stage of life.

O’Brien Insurance Agency can help!

At O’Brien Insurance, our clients are family and we make taking care of the people we serve our priority. If you’re giving thought to purchasing life insurance and would like guidance from insurance professionals who know its ins and outs well, give us a call today!

Who needs life insurance?

Who needs life insurance? What kind of coverage is best?

What kind of coverage is best?